Junior and Senior Bonds

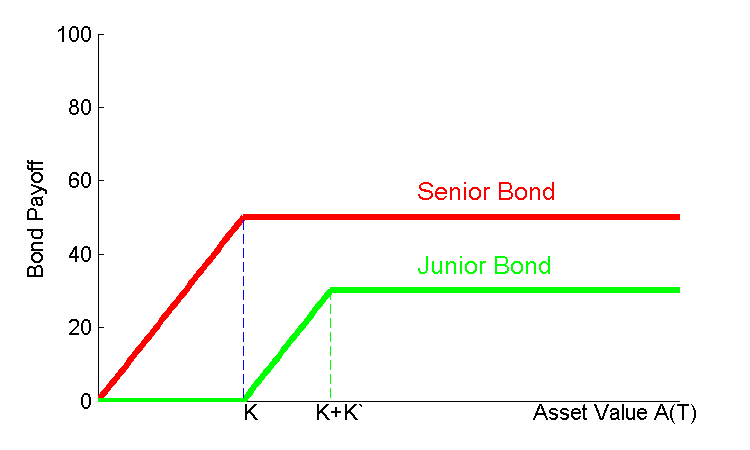

We can also introduce capital structure with senior and junior bonds. Suppose for instance that a pseudo firm issues a senior bond with face value K and junior bond with face value K’. In this case, the following payoffs take place at debt maturity

That is:

A(T) < K’ ⇒ Junior Bond = 0; Senior Bond = A(T)

K’< A(T) < K + K’ ⇒ Junior Bond = A(T) - K; Senior Bond = K

A(T) > K + K’ ⇒ Junior Bond = K’; Senior Bond = K

That is,

Payoff Senior Bond Holders = K – max(K - A(T), 0)

Payoff Junior Bond Holders = K’+ max(K - A(T), 0) – max(K + K’ - A(T), 0)

Graphically, the payoffs of junior and senior bonds are as follows:

The values of the two bonds are then given by

BS(t,T) = K Z(t,T) – PSPX(K,t,T)

BJ(t,T) = K’ Z(t,T) + PSPX(K,t,T) – PSPX(K + K’,t,T)

The (observable) balance sheet of the pseudo firm is then

Coval, Jurek, and Stafford (2009, AER) use a similar setting to compute benchmark credit spreads of Collateralized Debt Obligations (CDOs).