Why is the balance sheet of a pseudo firm observable?

Imagine that a pseudo firm purchases a traded security by issuing zero-coupon debt and equity. Following Merton (1974) insight, at debt maturity two scenarios can happen:

- The pseudo firm has asset values above the face value of debt, so that debt holders are paid off and all is good.

- The pseudo firm at debt maturity has asset values below the face value of debt, so that:

- The firm defaults;

- Equity holders are wiped out;

- Bond holders take over the firm, and assuming no bankruptcy costs, they receive the assets of the firm as payoff (see link to "examples" to find out how to model bankruptcy costs).

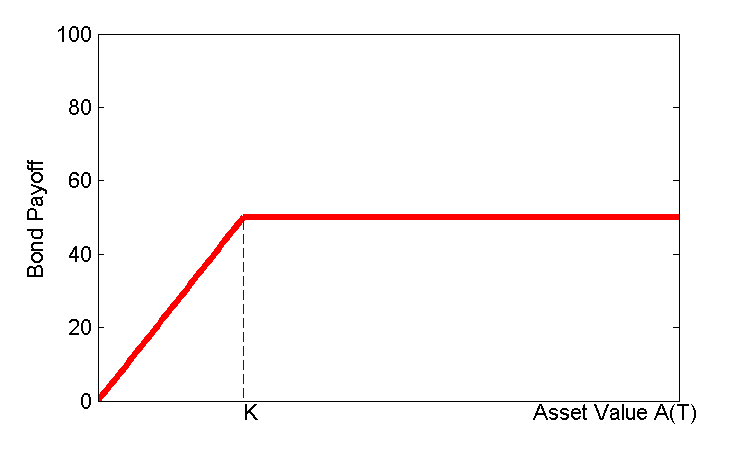

For instance, consider a pseudo firm that purchases one barrel of crude oil by issuing equity and a zero-coupon bond with face value K and maturity T . Bond holders have a payoff at time T equal to

Bond Holders' Payoff = min(A(T), K) = K-max(K-A(T), 0)

Following Merton (1974) insight, by no-arbitrage, the value of the zero-coupon bond issued by a pseudo firm is given by the value of a safe zero-coupon bond minus a put option on the asset of the firm. It follows that the balance sheet of such pseudo firm is fully observable: We observe the value of the asset of the pseudo firm (the value of the tradeable security); we observe the value of debt (Treasuries minus put options on the underlying traded security); and we observe the value of equity (assets minus liabilities, or call options plus adjustments for asset distributions).

In the example above, it follows that the value of the zero coupon bond “issued” by such firm is

B(t,T) = K Z(t,T) - POil(K,t,T)

where- Z(t,T) = price of a Treasury zero coupon bond;

- POil(K,t,T) = price of an option on one barrel of crude oil with payoff at T equal to max(K – A(T), 0 )

Above, E(t) stands for equity value, which in this framework can be computed as a residual from the accounting identity Assets = Liabilities.

Clearly, with data on spot oil prices, Treasuries, and options on oil, both assets and liabilities are observable.

Like crude oil, we can think of several underlying assets. Culp, Nozawa, and Veronesi (2015) consider commodities (oil, natural gas, gold, corn, soybean), foreign currencies (e.g. GBP, EUR, JPY,SWF), stocks and stock indices, and fixed income securities (through swaptions).