The Option-Based Laboratory for Credit Risk Analysis

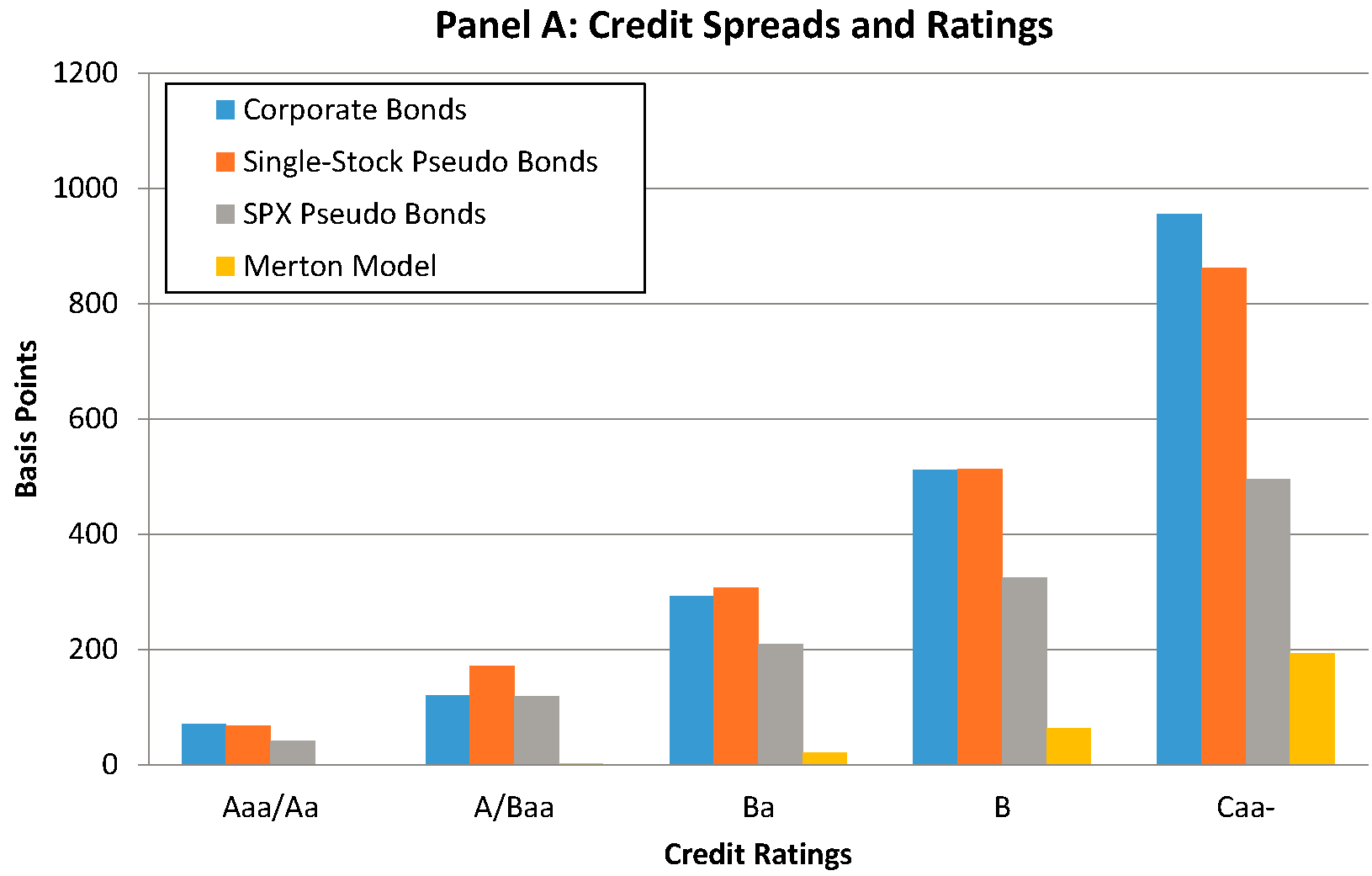

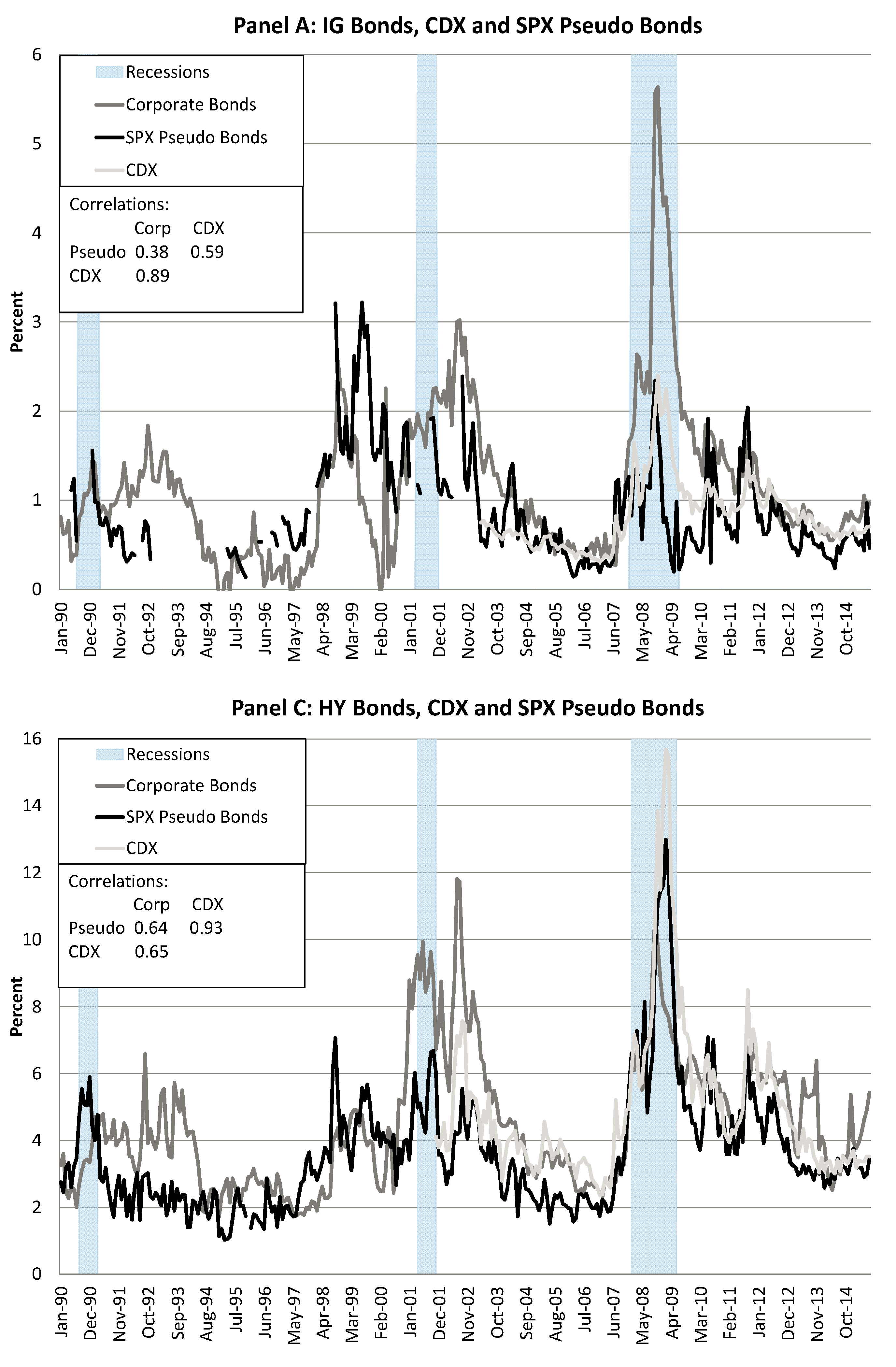

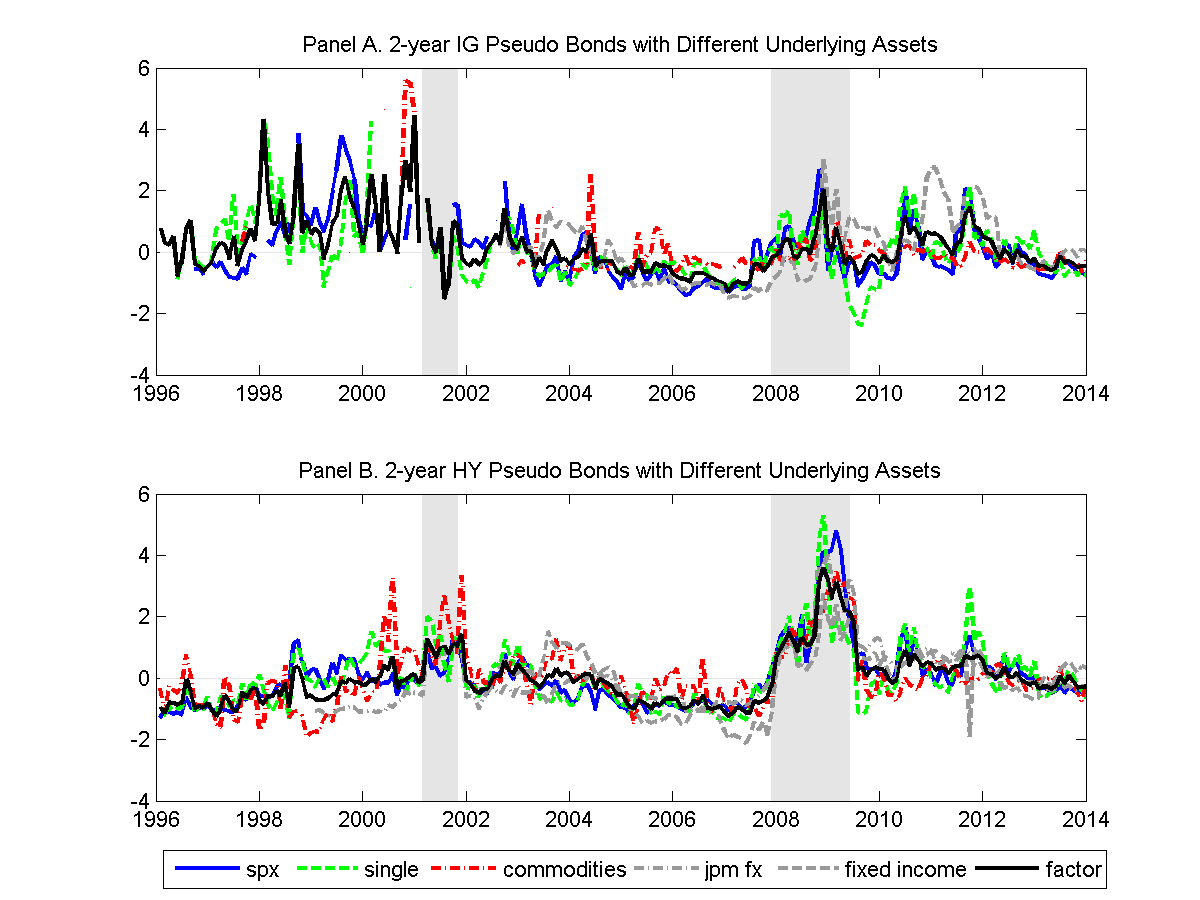

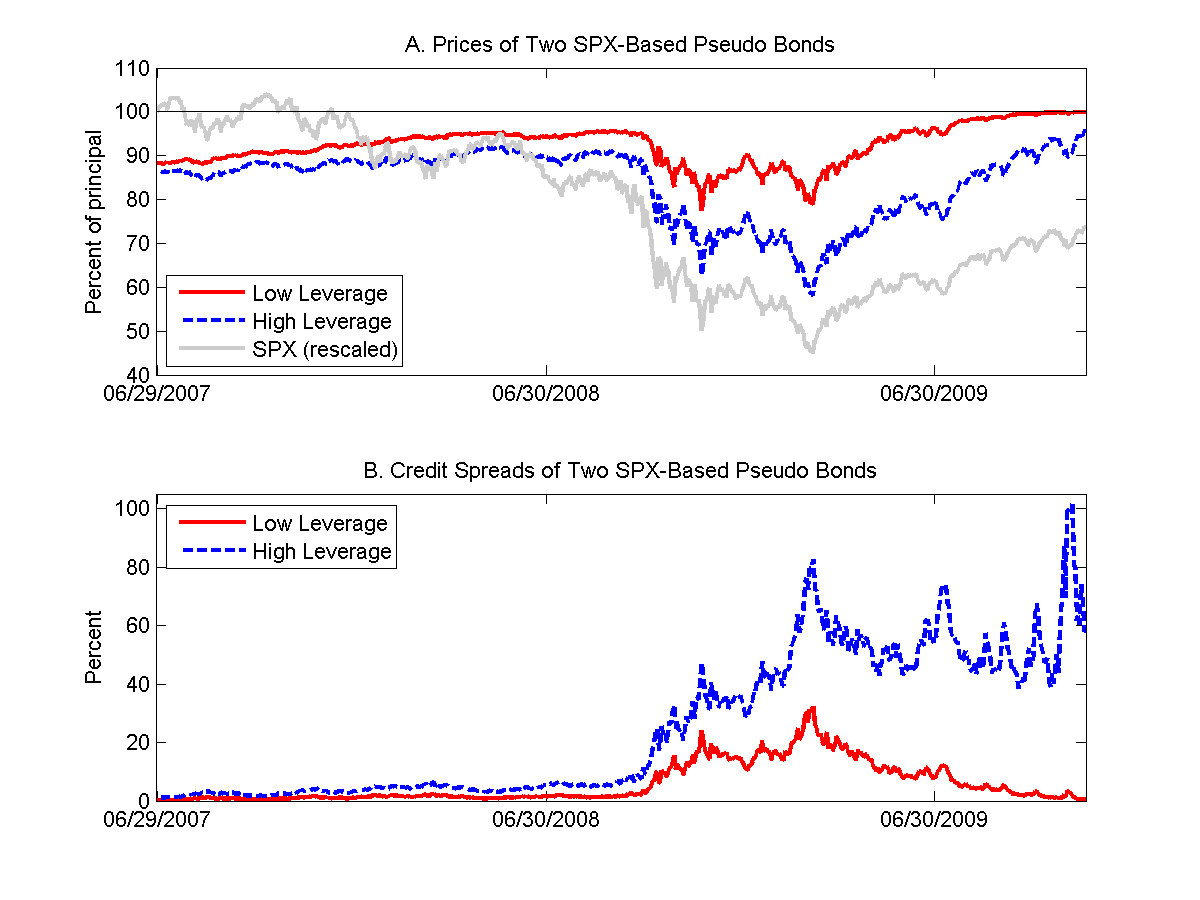

The understanding of credit risk is critical for both finance and economics. This research-oriented "laboratory" for credit risk analysis provides resources, such as data, examples, and explanations, on pseudo firms: hypothetical, fictitious firms that have simple, observable, and “manipulable” balance sheets.

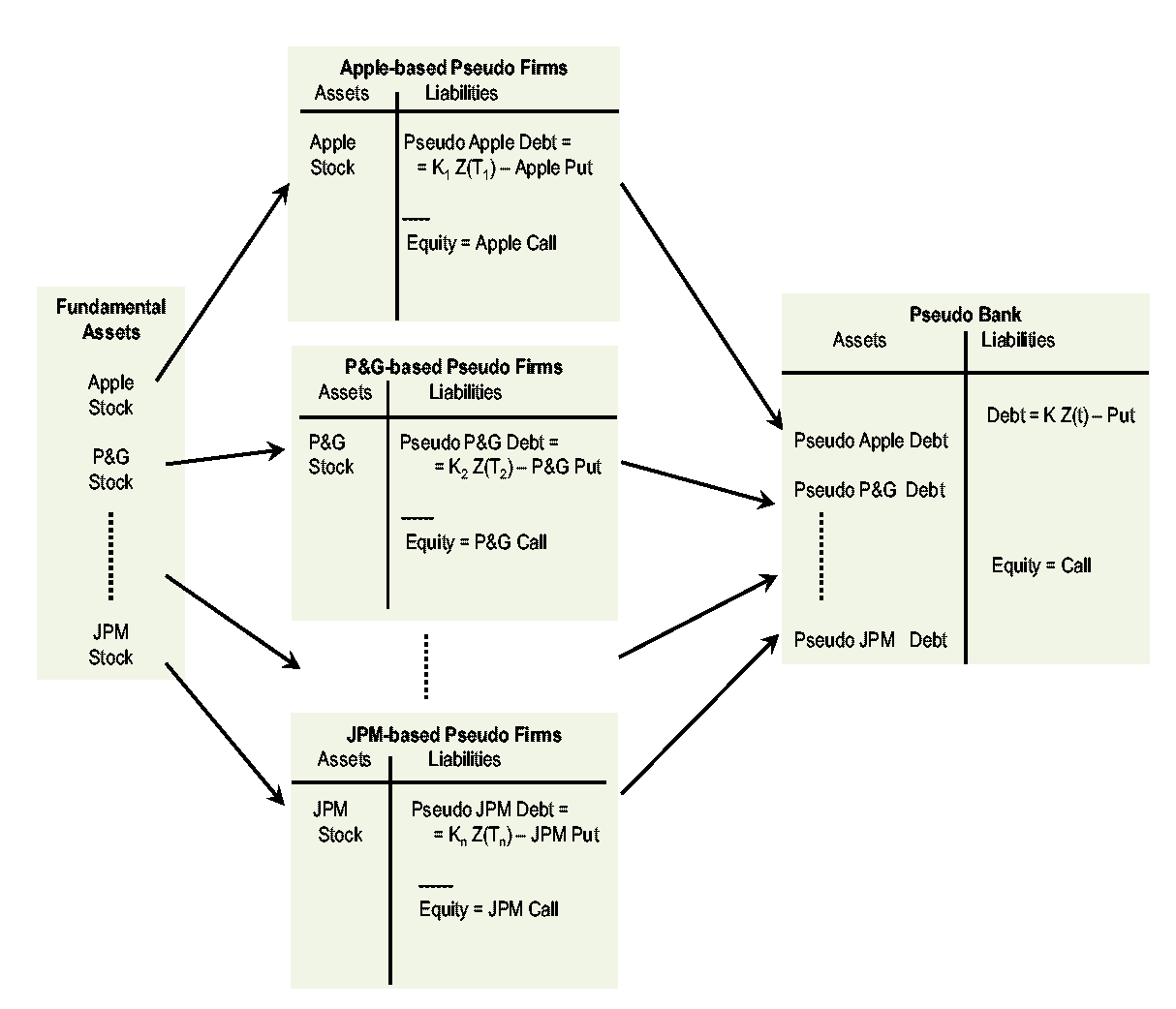

Pseudo firms are fictitious firms that we imagine purchase real traded assets by issuing zero-coupon bonds and equity. By using option prices and other traded securities, both assets and liabilities of pseudo firms can be easily computed. The simplicity of the methodology and the transparency of their balance sheets make pseudo firms ideal empirical benchmarks for credit risk analysis and experimentation.