Pseudo Financial Firms and Interest Rate Risk

Consider a pseudo firm that purchases a fixed-rate, level-coupon bond β(t,c,M) with unitary principal, coupon rate c, maturity date M, and LIBOR-equivalent credit quality. The pseudo firm finances its purchase of β(t,c,M) by issuing equity and a zero-coupon bond also with unitary principal, and maturity date T < M . The value of the asset of the firm at time t is then A(t) = β(t,c,M) .

If at maturity T the value of assets A(T) = β(T,c,M) is above principal (= 1), then the pseudo financial firm can liquidate some of the assets (or rollover) and payoff the debt. Bond holders obtain the unitary principal. If at maturity instead the asset value A(T)=β(T,c,M) is below one, then the financial firm defaults, and bond holders obtain the value of assets as payoff. Thus, bondholders have a payoff at time T equal to

Payoff Bond Holders = min(A(t), 1) = 1 - max(1- β(T,c,M), 0)The payoff max(1- β(T,c,M), 0) corresponds to the payoff of a payer swaption , that is, the option to enter into a swap at T and pay the fixed swap rate c until the maturity of the swap M.

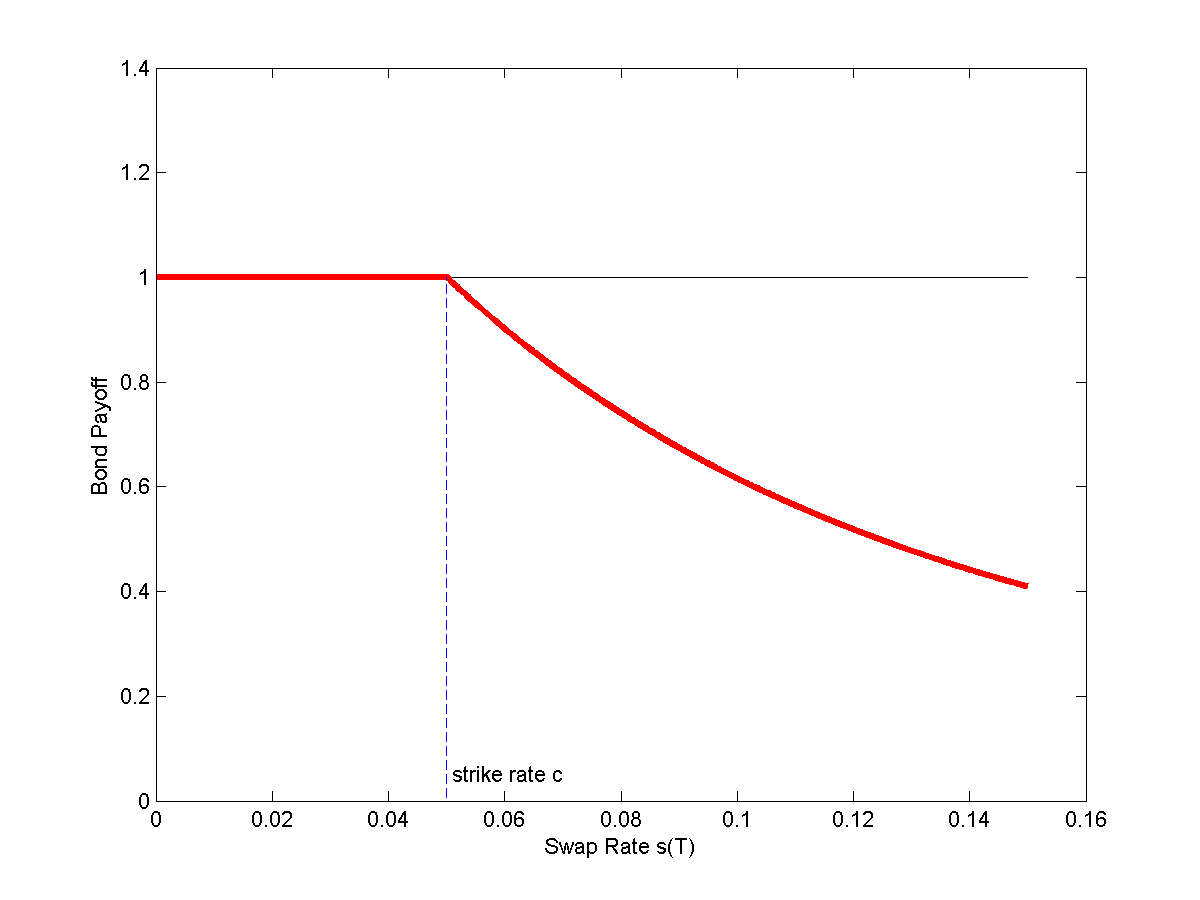

It follows that if at time T, the market swap rate s(T) is lower then the strike rate c, then β(T,c,M) > 1 , and hence the pseudo firm can pay bond holders the unit principal. If instead at time T, the market swap rate s(T) is higher then the strike rate c, then β(T,c,M) < 1 , and hence the pseudo firm defaults, and bond holders only obtain A(T) =β(T,c,M). Schematically:

s(T) < c ⇒ Bond holders' Payoff = 1

s(T) > c ⇒ Bond holders' Payoff = β(T,c,M)

Default risk in this setting depends on interest rates: When the interest rate is too high, the pseudo firm may default at time T, a situation that is clearly reminiscent of classic duration mismatch in banking. When a (real) bank makes long-term loans by financing with short term borrowing, an increase in interest rates may trigger default of the bank (as it lends at low rates and borrows at high rates.)

Next figure shows the payoff of the bond holders of the pseudo financial firm, plotted against the swap rate (the relevant interest rate in this case). Losses occur for high interest rates. Moreover, the payoff is not linear in the interest rate but convex, as bond prices are convex in the interest rate.

The value of the zero coupon bond “issued” by such firm is B(t,T) = Z(t,T) - Pswap(t,T;c,M) where

- Z(t,T) = price of a Treasury zero coupon bond;

- Pswap(t,T;c,M) = price of a payer swaption, that is, the option to enter into a swap at T, with swap rate c and maturity date M.

Above, E(t) stands for equity value, which in this framework can be computed as a residual from the accounting identity Assets = Liabilities.

Application: Pseudo Credit Spreads of Pseudo Financial Firms during the Financial Crisis

(data from Culp, Nozawa, Veronesi (2015))

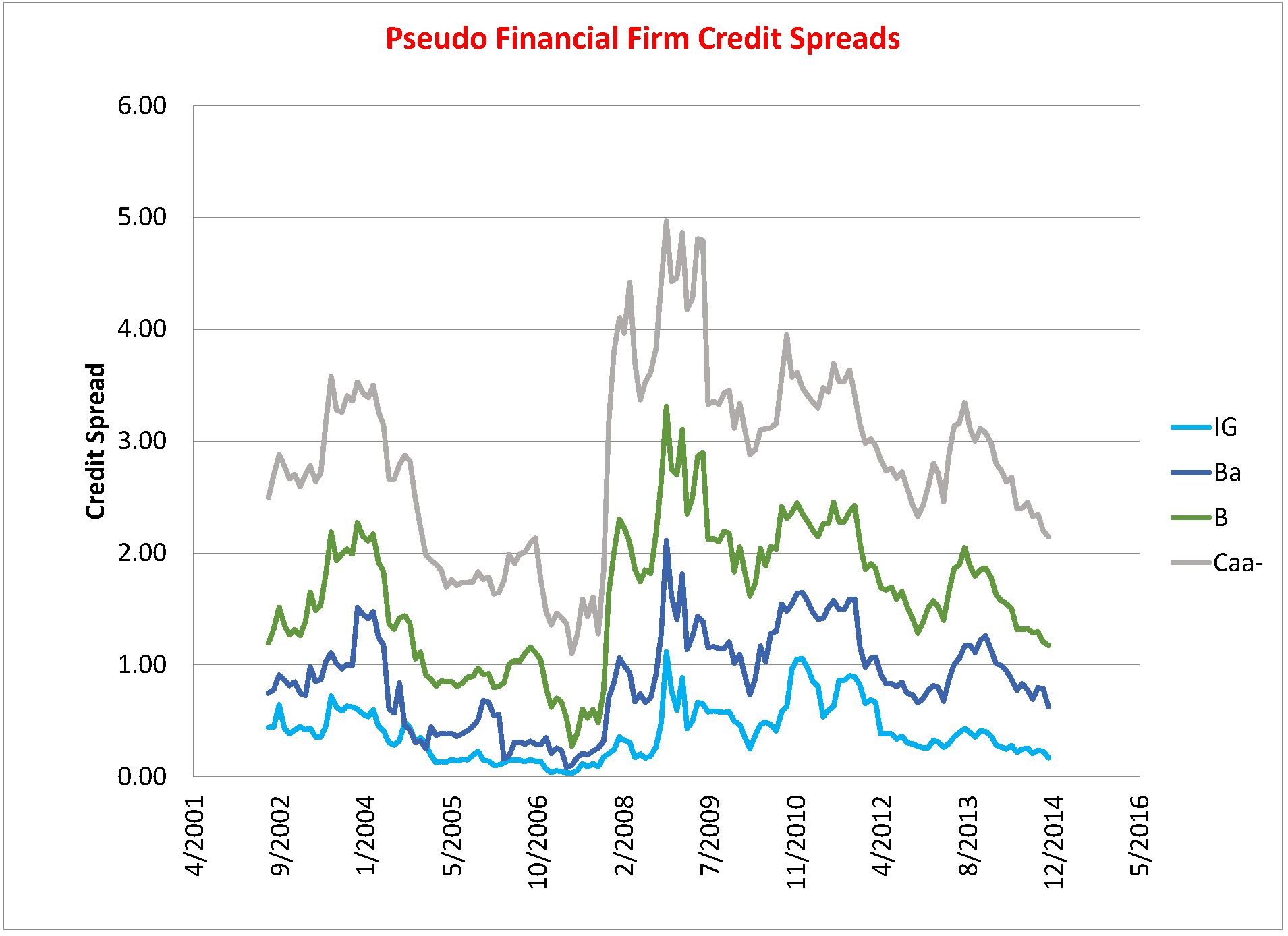

Consider a portfolios of pseudo bonds issued by pseudo financial firms. We resort pseudo bonds every month in order to keep their probability of default approximately constant. We consider here four "rating" categories, that approximately match the default frequencies of reported by Moody's Default Risk Service: Investment grade (IG), and Ba, B, and Caa-. These pseudo financial firms purchase fixed-rate coupon bonds with maturities of 5, 10, or 20 years, and issue zero coupon bonds with 3, 6, 12, and 24 months to maturity. We use the procedure outlined above and use swaptions to compute the value of the pseudo bonds issued by the pseudo financial firms. We then compute average credit spreads across credit rating categories. Next figure shows the result:

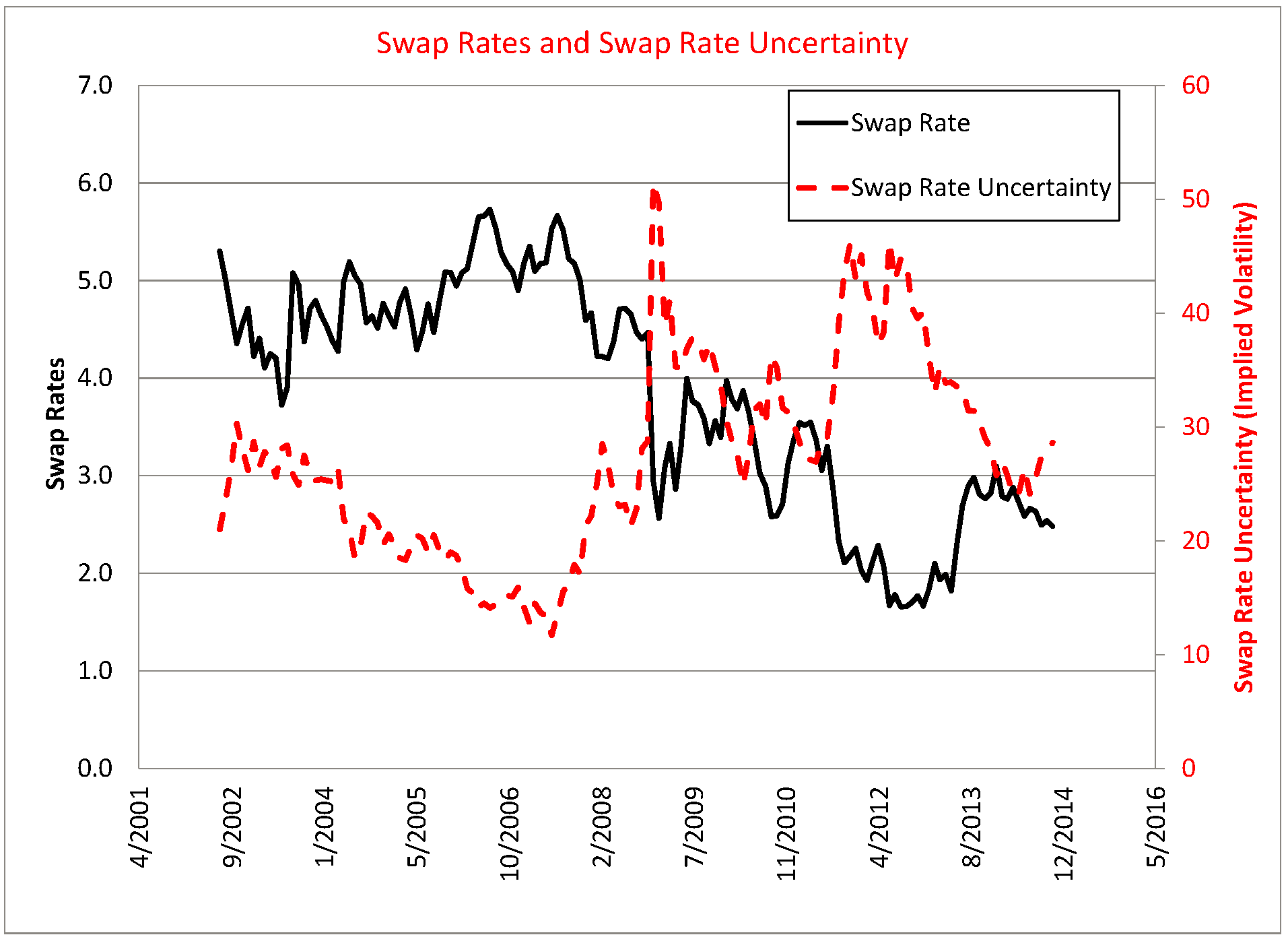

It is apparent that pseudo credit spreads of pseudo financial firms are moving over time. The interesting fact is that the pseudo credit spreads all these pseudo financial firms increased around the financial crisis, and some of them substantially. The main reason for the increase in credit spreads is uncertainty about the future interest rates, which affect the value of assets of our pseudo financial firms. Indeed, the next figure shows the time series of the interest rate (10-year swap rate) together with the time series of uncertainty (Implied Volatility from 10-year Swaptions).

The 10-year interest rate (swap rate) was actually either constant before the crisis, or declinining as we went through the crisis. According to the payoff illustrated above, the risk of default increases when interest rate increase, while during the crisis credit spreads increased as the interest rate declined. As illustrated, however, the uncertainty increased during the crisis, which is consistent with the credit crisis being largely affected by uncertainty. Clearly, as is well known, severe liquidity risk of real financial insitutions had generated a very volatile LIBOR rate, whose uncertainty affects the riskines and thus the credit spreads of our own pseudo financial firms.

This application neatly shows the complications in dealing with the interest rate risk of financial institutions, as default risk does not only depend on the level of interest rates (the usual "duration missmatch" problem) but also, and perhaps even especially, on the uncertainty about future interest rates.