Bankruptcy Costs

We can easily introduce bankruptcy costs for pseudo firms. Consider the case in which upon bankruptcy, the firm incur costs of k% of its assets. In this case, bond holders face the following scenarios at debt maturity

- If asset values are above the face value of debt, then bond holders receive the face value of debt, and all is good;

- If asset values are below the face value of debt, then

- Firm default;

- Equity is wiped out;

- Bond holders acquire the assets of the firm, and pay k% of it in bankruptcy costs: Payoff Bond Holders if Default = (1 – k) A(T)

Consider again the pseudo firm that purchases the S&P 500 (SPX) index by issuing equity and a zero-coupon bond with face value K and maturity T.

Bond holders have a payoff at time T equal to

Payoff Bond Holders = K – (1-k) * max(K - A(T), 0) – k *K 1(Default)

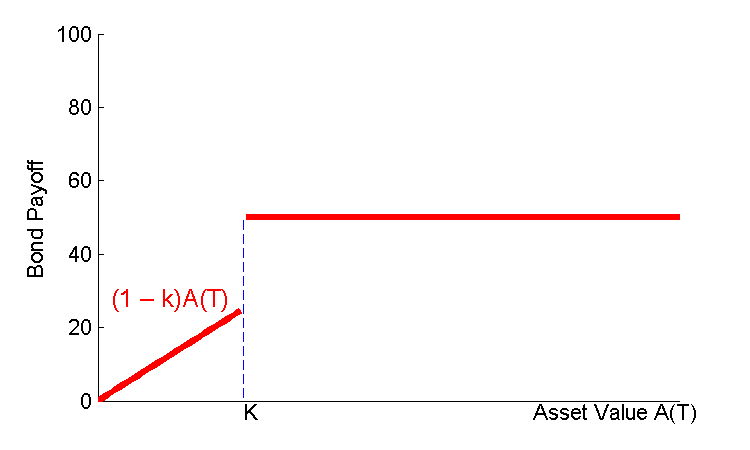

where 1(Default) = 1 if default occurs (i.e. if A(T) < K). Graphically, the payoff of bond holders with bankruptcy costs is given by

The value of the zero coupon bond “issued” by the SPX-based pseudo firm with bankruptcy costs is

B(t,T) = K Z(t,T) – (1 – k) PSPX(K,t,T) – k VDigital(K,t,T)

where VDigital(K,t,T) is the value of a digital SPX options that pays K if A(T) < K and zero otherwise.

A complication is that digital options are not traded (or at least, their prices cannot be easily obtained from standard datasets). We can approximate the value of a digital option with a portfolio of options

VDigital(K,t,T) ≈ K/(K – K’) [PSPX(K,t,T) – PSPX(K’,t,T)]

The approximated payoff at T is

Approximate Payoff of Digital Option ≈ K [max(K – A(T), 0 ) – max(K’ – A(T), 0)] / (K – K’)

That is:

A(T) < K’ ⇒ Approximate Payoff = K

K’< A(T) < K ⇒ Approximate Payoff = K [K – A(T) ] / [ K – K’]

A(T) > K ⇒ Approximate Payoff = 0

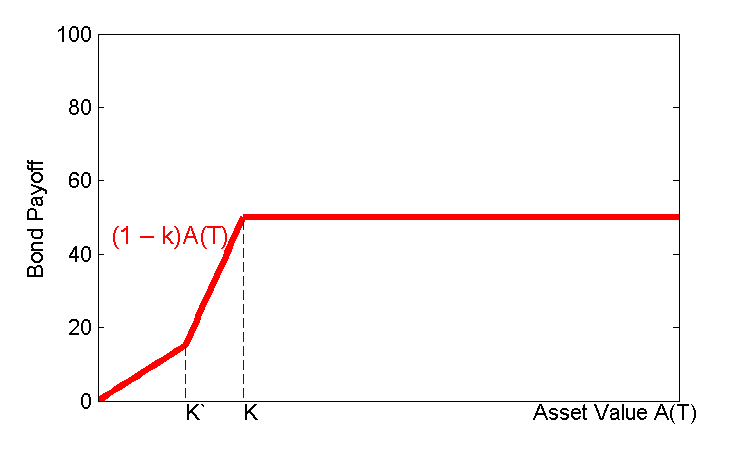

Graphically, the total payoff to bond holder with approximate bankruptcy costs is given by:

The advantage of using this approximation is that the portfolio is still a traded portfolio of put options and no interpolation is necessary. A disadvantage is clearly that the approximation is not perfect.

On the other hand, this setting would also be consistent with bankruptcy costs that depend on the amount of shortfall of assets over the face value of original debt K.

The bankruptcy cost k can be calibrated to obtain losses given default of pseudo bonds that mimic the ones of real corporate bonds.